We all make mistakes.

Sometimes these mistakes are minor. But other times they’re grave.

When it comes to accounting and BASs, it’s crucial you avoid these mistakes.

Are you paying more Income Tax than you need to? Or getting hit with ATO Fines due to missing BAS deadlines?

All too often I see businesses make these mistakes.

Think of it like this…Are your current systems so streamlined that you’re on top of your BAS each quarter?

Probably not.

I realise it can be tough. Especially if you’re busy growing your business.

But don’t worry, I’m going to show you how to simplify the process. And I’ve narrowed it down to 4 tips to make your BAS easier.

Refunds on Fines

Let’s start with the basics…and help you avoid those pesky ATO penalties.

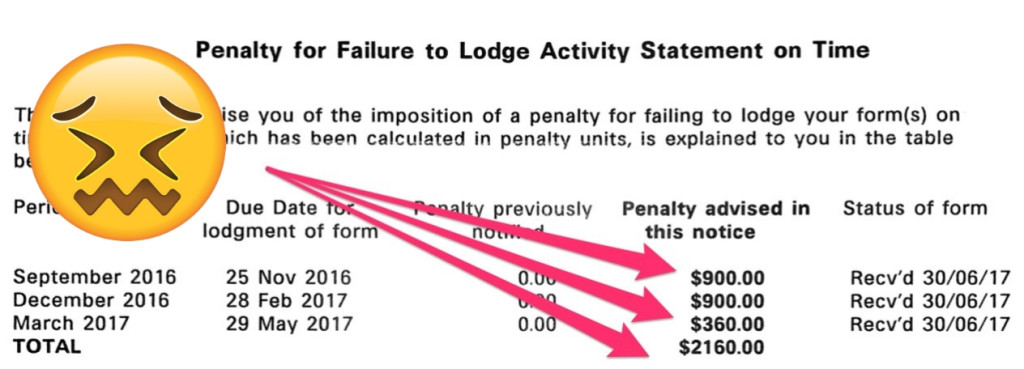

If you submit your BAS late, here’s what will happen. You’ll receive a penalty from the ATO with fines between $210 – $1,050!

But there’s some easy steps to avoid that…

Firstly, you definitely want to know your BAS due dates. These are quarterly on the 28th of each of these months.

My suggestion is this…Mark the dates in your calendar for 2 weeks earlier.

For the due date of 28th February, mark it down right now for 14th February.

Here’s something else to consider.

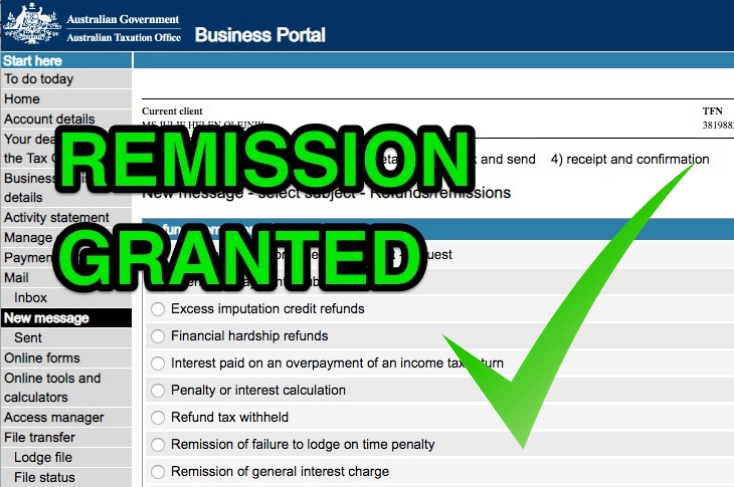

If the worst happens and you’re fined, the great thing is it’s possible to get your money back by applying for a refund.

Check this out…

Through the Business Portal you can apply to recover those fees!

The key is to provide a good reason for the late BAS. So provide an explanation such as computer, software or staff issues.

This will save you hundreds of dollars.

Now that’s powerful!

Missing Out on GST Credits

Here’s your second tip…

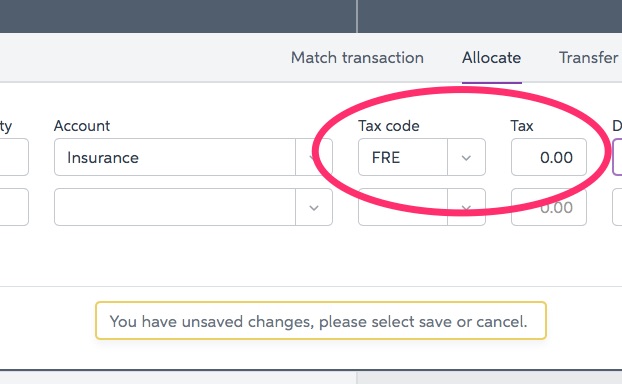

Are you losing money to the ATO by overlooking GST credits?

Some software can classify transactions as having no GST, such as Insurance. And some insurances do include GST, which means you’ll lose out to the ATO.

It’s a common mistake, that’s easy to make.

You’ve got an easy option here…

Get organised with invoice scanning software. It’s simple to set up and registers the correct GST into your software.

As a result, you won’t miss out on claiming the GST credits you’re entitled to.

Paying Too Much Income Tax

Here’s something else that may surprise you.

You might be paying more Income Tax instalments than you need to. That’s because, in the BAS Income Tax section you use the percentage the ATO gives you.

But consider this. You can vary the percentage if there’s a change in trading conditions.

To show you what I’m talking about, here are some examples:

Perhaps you’ve lost a major client or contract.

Or there’s been a significant downturn in sales.

As you can see, it doesn’t make sense to use the current percentage, as your instalment will be too high.

It makes sense to vary the rate. Just remember to know the different reasons and be aware when they occur.

This is a great strategy.

It’s one that means you won’t pay more tax than you need to, which will help with cash-flow.

Payroll Errors

Trust me, getting payroll issues wrong can have serious consequences.

You may have seen in the news recently what these consequences can be.

As a business owner, you need to get the payroll section of your BAS right, and report employee payments accurately.

Otherwise you’ll end up spending your time having to fix it. Or if there’s a repetitive error, you can be taken to court.

With some simple checks you can massively improve your chances of getting it right.

Here’s how it works..

For starters, use the Awards site for choosing the right Employment Award.

And ask yourself these questions…

Am I aware of the obligations around Carer’s Leave? Compassionate Leave? Long Service Leave? Casual Loading?

These issues are clearly outlined on the Fair Work website. So make sure you’re fully informed!

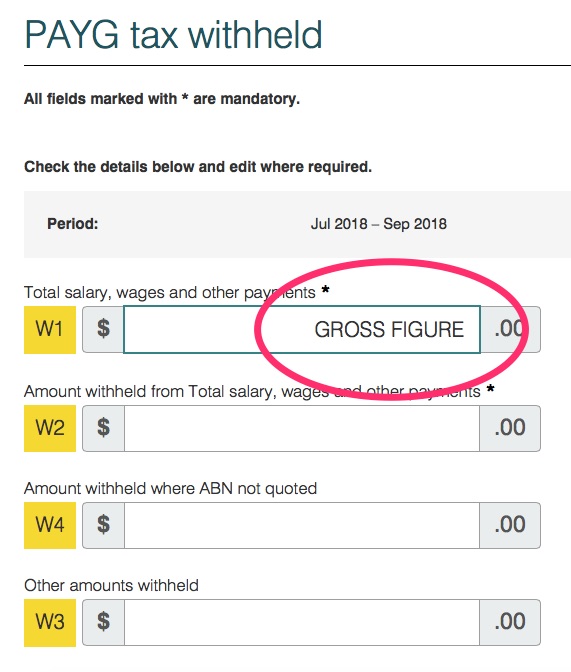

I see businesses make another mistake with Employees and their BAS.

In the following section of your BAS make sure the Gross Payroll figure is used, not Net.

Errors like this can make you a target for the ATO.

And obviously the last thing you want is a red flag for the ATO to audit you.

Summary

What does all this mean for you…

It’s crucial as a business owner that you understand your accounts.

To do this, you need clear accounting information that makes sense to you. And getting your BASs right is part of that.

So follow the tips and advice I’ve outlined for on-time and accurate BASs.

And as a result, your chances of success in business will be so much higher.

Free Accounts Health Check

We have a special offer. Click below to get your Free Accounts Health Check.

What You’ll Get:

✅ Analysis of current accounting / books setup

✅ Identify issues

✅ Provide recommendations